For many young professionals, "House Hacking", i.e. purchasing a primary residence and renting out part of the home to offset expenses, is a great way to purchase their first home while significantly reducing (or even eliminating) monthly housing costs.

This post explores the financial and tax benefits of house hacking—complete with an illustrative example.

Real Estate with High Interest Rates

2023 has witnessed the largest increase in interest rates in decades, casting a shadow of uncertainty over various investment avenues, particularly real estate.

This blog post delves into the dynamics of investing in real estate in such an environment, offering insights and strategies for investors to navigate these choppy waters.

This blog post delves into the dynamics of investing in real estate in such an environment, offering insights and strategies for investors to navigate these choppy waters.

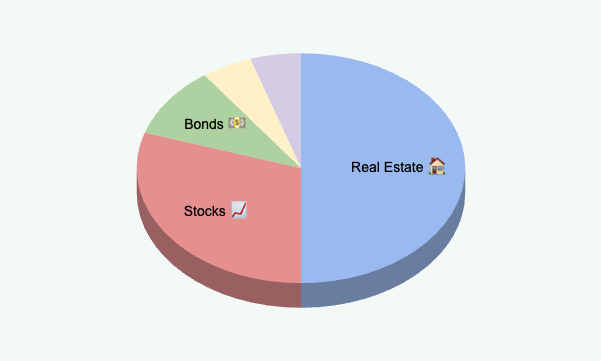

Balancing Index Funds and Properties

One of the easiest and most effective ways to invest is to put your money in a broad-market index fund, such as SPY, VTI, or a target retirement fund in your 401k. These funds are low-cost, highly diversified, and track the overall health of the economy well.

If an investor already has a broad-market stock portfolio, should she divest from this portfolio and invest in real estate? What percentage is optimal?

If an investor already has a broad-market stock portfolio, should she divest from this portfolio and invest in real estate? What percentage is optimal?

Tax Efficiency of Rental Real Estate

Many prospective rental property owners like the appeal of generating passive rental income, but worry about the associated tax burden, both financially (“Will my rental income drown me in taxes?”) and logistically (“How can I take care of all the necessary filing?”)

Today we unpack the finances behind a typical residential property. We will use actual numbers to explain why real estate is widely considered as a tax shelter, and how zero taxes on rental income during property ownership can be achieved with relatively little work. For the most advanced investors, we will provide some advanced pointers as well.

Today we unpack the finances behind a typical residential property. We will use actual numbers to explain why real estate is widely considered as a tax shelter, and how zero taxes on rental income during property ownership can be achieved with relatively little work. For the most advanced investors, we will provide some advanced pointers as well.

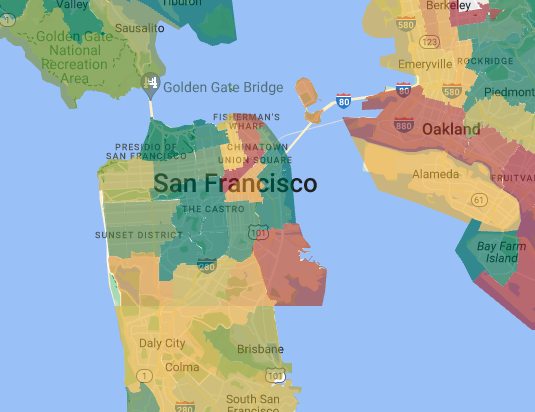

Classes of Neighborhoods

Understanding the returns profiles of “Class A” vs “Class C” at a high level is super important in ensuring you get investment results that are consistent with your expectations.

Let's delve into these neighborhoods, the metrics for classifying them, and their return profiles, all using specific examples to help you make informed decisions about where to invest.

Let's delve into these neighborhoods, the metrics for classifying them, and their return profiles, all using specific examples to help you make informed decisions about where to invest.

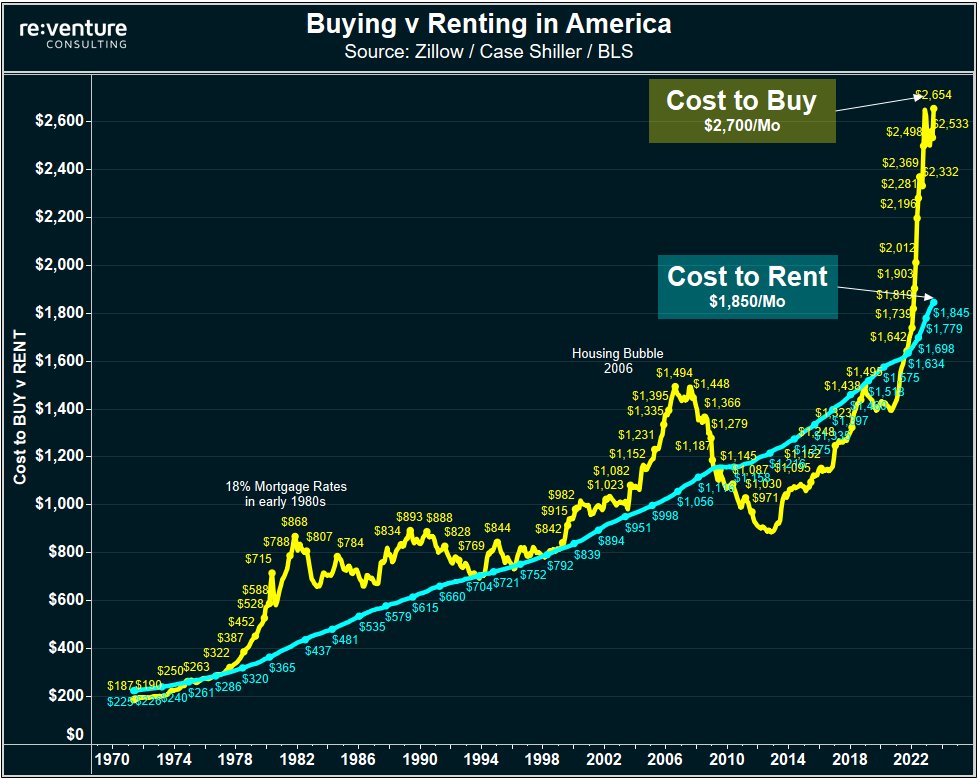

Advanced Considerations in Buy vs Rent

So much has been written about the age-old question of whether to buy or rent your primary home. The very basics often take center stage: rent vs mortgage, property taxes, lifestyle differences, etc. We will not pile on to the existing literature.

This article will help you evaluate the more advanced financial implications of buy vs rent. These considerations can often change purchase or rental costs by 50% or more and tilt the decision, especially for high-income earners, but they require deeper financial knowledge and are not typically suitable for the average Internet reader. If you are already acquainted with the basics and are ready to nerd out about the “advanced level”, let’s get started.

This article will help you evaluate the more advanced financial implications of buy vs rent. These considerations can often change purchase or rental costs by 50% or more and tilt the decision, especially for high-income earners, but they require deeper financial knowledge and are not typically suitable for the average Internet reader. If you are already acquainted with the basics and are ready to nerd out about the “advanced level”, let’s get started.