Balancing Index Funds and Properties

One of the easiest and most effective ways to invest is to put your money in a broad-market index fund, such as SPY, VTI, or a target retirement fund in your 401k. These funds are low-cost, highly diversified, and track the overall health of the economy well.

If an investor already has a broad-market stock portfolio, should she divest from this portfolio and invest in real estate? What percentage is optimal?

Disclaimer: The information provided in this article is for informational purposes only. We are not financial or tax advisors. You should consult with a professional in the relevant field.

Why do cap-weighted index funds work well?

Many modern financial advisors advocate for low-cost, broad-market index funds as the preferred vehicle for stock investment. Many investors follow the advice but may not fully understand the underlying principle of why these funds serve investors so effectively.

Most broad-market index funds are based on the efficient market hypothesis and the empirical research1 that most active stock pickers do not outperform the market. Since it’s almost impossible to consistently pick outperforming stocks, we might as well give up the fool’s errand and simply buy shares of all companies within an index, indiscriminately.

The index funds purchase stocks in proportion to the companies’ value, so the entire portfolio is a weighted sample representative of the entire market. This approach avoids paying expensive fund managers to actively pick stocks. It also lowers transaction costs because of low portfolio turnover. Mathematically, index funds are guaranteed to produce “average market return”, because the index is the “market”. In theory, they neither outperform nor underperform; in practice, the low fee makes them superior to most active funds that charge more fees but still do not outperform anyway.

Extending cap-weighting to other asset classes

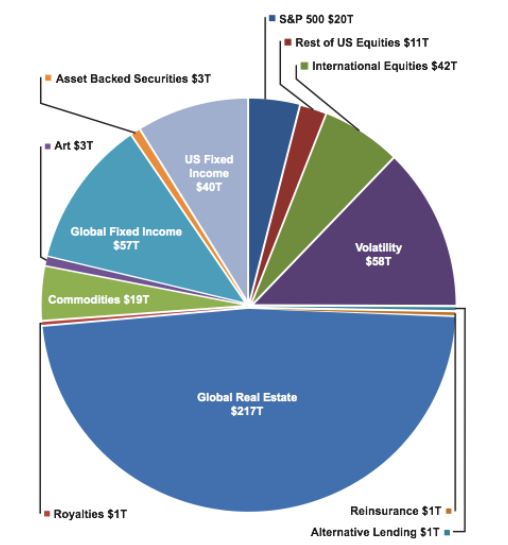

Passive index funds should remain a good choice for stock investments for most investors. However, an index fund investor is only buying a representative sample of the whole “stock market” but not a representative sample of the broader investment universe. The broader universe consists of assets other than stocks: real estate, bonds, volatility, or even more esoteric assets such as bitcoin, farmlands, uranium, oil, fine art, etc. Purchasing a diverse set of investments helps distribute risks more broadly and achieve uncorrelated returns.

Historically, many of these assets have extremely high barriers to entry (you cannot buy $10,000 of oil and store it in your swimming pool), so investment literature mostly ignores them. In addition, measuring the exact weight of these assets can be difficult - stocks are the most easily measurable assets because we can look up a company’s total shares and share prices easily, but it’s much harder to estimate how much real estate is in the US or how much is total US timberland worth.

Many researchers still attempt to produce these estimates, however.

These estimates are never precise, but they always illustrate the sheer weight of real estate as a percentage of total assets. If one takes a pure “passive, cap-weighted” approach to investing, real estate should be roughly 50% of one’s net worth. Likewise, it wouldn’t be a bad idea to add small allocations to bonds, commodities, etc..

We are not financial advisors, and we are definitely not your financial advisors, so you should discuss with your professionals whether you should target 50% real estate in your portfolio. That said, the asset allocation of all stocks likely goes against the investment principle of investing in cap-weighted, passive, and diverse assets.

Practical real estate allocation percentages

One big drawback to real estate investment is the low liquidity and high barrier to entry. You cannot buy $10,000 worth of real estate - a house in the cheapest neighborhood costs a lot more than that. While there are some Real Estate Investment Trusts (REITs) on the public market, shares in a REIT tend to represent more commercial real estate classes, such as apartment complexes, shopping malls, and industrial warehouses, rather than plain vanilla houses.

For most people, the biggest real estate allocation is their primary residence. We all need a place to live, and primary residence carries a lot of federally backed incentives (such as mortgage interest deduction)2 - in most cases, it’s a sensible idea to purchase a primary residence if you intend to stay for a long time. For the median American, this is likely a sufficient allocation to real estate for decades of their career.

For many of our higher income earner clients, a single primary residence is not sufficient allocation to real estate. One couple that both work as software engineers in the San Francisco Bay Area would likely generate a few million disposable savings over the course of a decade. An entry-level house in the Bay Area may cost $1-2M, and not close to half of the net worth, not to mention that the $1-2M is mostly borrowed. A 50% allocation would necessitate either:

- Upgrading their primary residence significantly

- Purchasing additional investment properties

Between (1) and (2), we generally recommend (2): purchasing higher and higher-end real estate in a single market is putting way too many eggs in a single basket. In addition, simply living in more and more luxury real estate significantly increases your housing consumption and lowers your saving rate. Purchasing additional investment properties to achieve your target real estate allocation can be a good idea.

In addition, asset allocation isn’t just about diversifying across different asset classes, but also within them. If a significant portion of your wealth comes from stock-based compensation from a tech company, it’s wise to avoid tech-heavy markets for your investment properties, e.g. San Francisco, Seattle, or Austin, TX. By buying property there, you’d be doubling down on the tech industry’s success. Instead, consider markets that aren’t closely linked to tech, thereby ensuring your assets aren’t all vulnerable to the same economic shocks.

- 1.A Random Walk Down Wall Street is a great resource with further details. ↩

- 2.For more details, read Advanced Considerations in Buy vs Rent ↩