Classes of Neighborhoods

If you’re looking to purchase residential property for investment purposes, you’ve probably heard of neighborhood classes. Understanding the returns profiles of “Class A” vs “Class C” at a high level is super important in ensuring you get investment results that are consistent with your expectations.

Let’s delve into these neighborhoods, the metrics for classifying them, and their return profiles, all using specific examples to help you make informed decisions about where to invest.

The ABCs of Neighborhoods

“Class A/B/C” is commonly used by professional real estate investors to classify neighborhoods.

In the most “premium” neighborhoods, Class A areas tend to have residents with stable jobs and high earning potential. Rent affordability is usually not a concern for most residents. These areas tend to have better schools, and nicer houses, and property values tend to be less volatile.

However, the stabler return makes the asset less risky and attractive to more affluent buyers. In addition, many potential buyers are owner-occupants in high tax brackets. They benefit disproportionately from mortgage interest deduction and can make aggressive offers. (An owner occupant paying $40,000 interest a year is effectively only paying $20,000 in housing cost if her marginal tax rate is 50%, a very common bracket in states like California) So these properties tend to have disproportionately higher prices and lower rental returns as a percentage of price.

On the other extreme, Class C properties generally have attractive rental yields, but they tend to be located in neighborhoods with higher crime, weaker schools, and residents with a higher chance of rent delinquencies. These properties tend to have more issues that require hands-on attention. For investors who are busy professionals, this usually means that they have to partner with management professionals with strong operational excellence.

Metrics for Classification

There isn’t a precise definition of “Class A” vs “Class C”. Real estate agents often use “gut feelings”, e.g. “This is an upscale neighborhood”, without referencing any hard data. Sellers often exaggerate the positives to market and upsell the property.

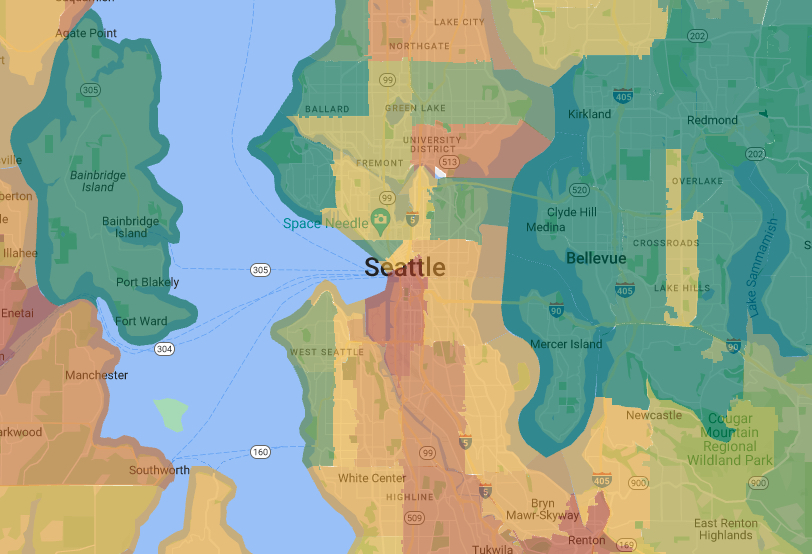

In our experience, median income is one of the best metrics to measure the overall neighborhood classifications, because it really correlates with overall quality of life in the neighborhood. Institutional-grade tooling often aggregates decennial US Census data and annual American Community Survey data and can analyze median income metrics for every census tract or zip code. We publish some of these toolings, for example, neighborhood metrics for every single metropolitan area in the US, to help you invest better as well. In the above Seattle example, dark green areas represent the most affluent neighborhoods, and dark red, the opposite.

Income data alone does not fully capture every aspect of a neighborhood and has a few caveats:

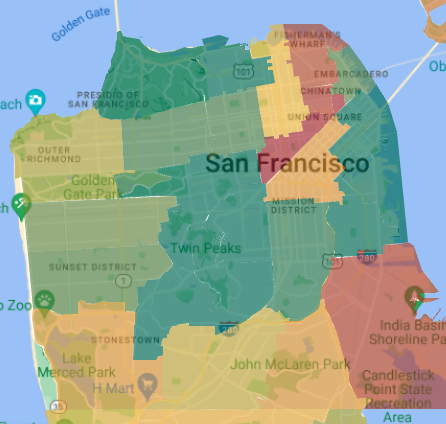

- Sometimes “high income” does not necessarily equal “nice neighborhood”, especially in urban environments with lots of working professionals, who can skew up the income. For example, some of the green areas of San Francisco can have high crimes and high tenant turnovers.

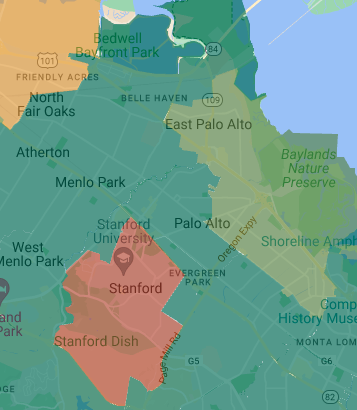

- Colleges tend to have the “poorest” residents (students have no income) but are usually the nicest neighborhoods.

- In “Class A” neighborhoods, there can still be especially rundown properties that behave more like a “Class C” property, and vice versa. One needs to adjust for the actual condition of the property relative to the surrounding area.

Overall, the caveats rarely apply, and we have found data-driven approaches to be very helpful in selecting the right neighborhood for investment purchases.

Investor-Market Fit

Investing in real estate is not a one-size-fits-all approach. A young, entrepreneurial investor likely will find “Class C” properties especially attractive due to lower price points and higher potential for appreciation on a percentage basis. She may not mind the management headaches and may even put in “sweat equity” to perform maintenance, repairs, and even remodels to accelerate property appreciation.

Many busy high-income professionals live in “Class A” areas themselves. They want to have an acceptable rental yield and potential for neighborhood upscaling and appreciation but do not want to deal with any management overhead with rental properties. Properties in “Class A-” or “Class B+” areas can be a great fit for them, and we can help take care of any day-to-day management to achieve a passive, hands-off experience.